Depreciation formula example

Straight-line depreciation Original value Salvage ValueUseful Life. Depreciation Per Year Cost of Asset Salvage Value Useful Life of Asset.

5 2 Ex 1 Financial Maths Depreciation Youtube

Assume the life of machine 18 years.

. Actual cost of Acquisition of an Asset after considering all the direct expenses related to acquiring of asset borrowing cost and any directly attributable cost to bringing the asset to its present condition and location like. The formula for calculating Straight Line Depreciation is. It includes taxes paid or shipping charges paid for the asset if any.

Example of Straight line method. Using the previous example if the computers lifespan is six years the straight-line depreciation rate would be 1 6 or 016. 8 essential business manager skills Double-declining balance depreciation.

Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. It is the initial book value of the asset. Annual depreciation 2000 500 5 years 1500 5 years 300 According to straight-line depreciation the computer depreciates by 300 every year.

Depreciation Rate per year. The company estimates it to have a useful life of 10 years. N 18 years.

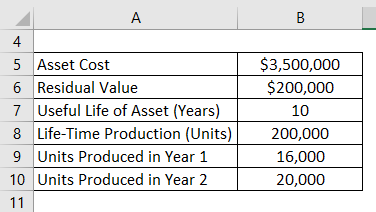

IRS defines depreciation as a technique of income tax deduction that aids. You can also prepare a depreciation schedule in Excel using the Units of Production methods. The formula for this method is as below.

Multiply by 100 to determine this as a percentage16 of the original value for each year of the assets lifetime. SLM Annual depreciation expense Original cost of asset - Salvage value of asset Useful life of asset. Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable.

Using straight line method Annual. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Suppose if the cost of a motor is rs20 000 its useful life is 4 years and scrap value is Rs2000 the annual depreciation will be 20000- 2000 18000 divided by 4 Rs4500.

Unit of production method. Once calculated companies use the same rate for each asset in that class. The present value of machine is Rs.

This rate then goes into various depreciation methods to calculate the depreciation for every asset. Use straight line method for finding depreciation. Assume a business buys a machine for INR 1crore with a useful life of 25 years and a salvage value of INR 10 lakhs.

Example A company Green Co purchases a vehicle for 10000. Depreciation rate 1 Assets useful life x 100 Once calculated companies use the same rate for each asset in that class. The unit of production method calculates the depreciation based on the units produced by an asset.

The depreciation for one period using units of production method is determined using the equation. The straight-line method for annual depreciation can be calculated using the formula. 250000 workout the depreciated cost at the end of 7 year if the salvage value is Rs.

Ad Edit Sign Print Fill Online Depreciation Worksheet more Subscribe Now. SLM depreciation 10000000 100000025 360000. Depreciationcost-salvagelife in unitsUnits produced per period.

This rate is calculated as per the following formula. To use this method you need to know the unit produced per period. It estimates the per-unit depreciation cost and allocates it based on the total units produced.

Annual depreciation cost residual value year of useful life. Depreciation expense 2 x Assets book value x Depreciation percentage. The annual amount is calculated as.

C 250000 Rs. Depreciation Value per year Cost of Asset Salvage value of Asset Depreciation Rate per Year. 1useful life of the asset.

Depreciation Formula Examples With Excel Template Determine the cost of the asset. S 20000 Rs.

Depreciation Formula Calculate Depreciation Expense

Declining Balance Method Of Depreciation Formula Depreciation Guru

Depreciation Calculator

Depreciation Formula Calculate Depreciation Expense

Depreciation Calculation

Depreciation Formula Examples With Excel Template

Double Declining Balance Depreciation Calculator

How To Use The Excel Db Function Exceljet

Depreciation Formula Examples With Excel Template

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

Annual Depreciation Of A New Car Find The Future Value Youtube

Straight Line Depreciation Formula And Calculation Excel Template

Depreciation Expense Double Entry Bookkeeping

Depreciation Methods Principlesofaccounting Com

Straight Line Depreciation Schedule Calculator Double Entry Bookkeeping